“When the bank asks for them. Otherwise, why bother? …It’s just a bunch of numbers on a page.”

Those were the precise words of a small business CFO in response to my question as to how often he generated financial statements for his company.

Prior to that, I had asked the CEO how often he reviewed his financials. To which he replied, “I’ve never seen them.”

You’re Busy

Let’s face it, other than single moms – or single parents in general – small business owners are the busiest people on the planet.

- Maybe you don’t feel you have the time to review financial statements.

- Or maybe you don’t have a CFO or other means of generating financial statements on a regular basis.

- Or maybe you do review them but you’re just looking at them from an historical perspective.

If any of these three scenarios apply to you, you’re deriving less than half of the value of financial statements – at best!

So, here’s a series of short videos to help you transform your financial statements into invaluable information that will give you greater insights into historical performance but, more importantly, a structure for proactively managing your company.

You Can Do This Over Lunch

You may have your bookkeeper or CFO make these adjustments but it is important that you understand them.

So just sit back, relax and watch these 5 short videos that will empower you to take mundane financial information and turn it into actionable data that you can use to proactively improve the performance of your company.

Here’s How to Gain Greater Control by Transforming

Financial Statements into a Foundation for

Proactive Management of Your Company

(All videos best viewed in full screen mode)

In this introductory video, I lay the ground work for how you can easily convert “a bunch of numbers on a page” into management segments that represent the way YOU see your company.

That’s why it’s important that YOU watch these videos.

You want your financial statements to tell you a story each month.

And you want them to tell you the story as YOU want to understand it.

Introductory Video – Structuring the way you want to see it

So now that we have the basics established, let’s take a look at…

An Example using COGs:

You see, the IRS doesn’t care how the financials are structured in this regard.

We have this discussion with business owners all the time. “But my accountant…”.

Your accountant’s job and main concern is to conform to GAAP.

The bottom line is – well, it’s the bottom line: as long as profit is accurately reported, you can structure your financials any way you want.

Oh, and another thing with regard to bookkeepers. They are not mind readers and they don’t necessarily understand the operation of your company.

So you might find entries for ‘Other’ or ‘Miscellaneous’ or new accounts set up for a misspelling of an old account. We’ve seen it all.

Don’t allow it!

You can’t manage to a ‘miscellaneous’ or ‘other’ expense.

When you get your financial statements structured to tell you the story of what’s actually going on in your company, you’ll want accuracy in everything that is entered.

So now that you have the hang of it, let’s look at a way to organize all of your operations in a way that every member of your team will understand which will provide…

The Foundation for Establishing Alignment and Accountability while Inspiring Engagement

You see, once you have a structure that everyone can readily understand, employees will have a better sense of how their performance impacts the performance of other team members and the company as a whole.

So now it’s time to…

Apply the Structure to Overall Company Operations

Again, this post was created to get you started on structuring your financials so that, rather than just conforming to tax requirements or a vague historical review of profit and loss, you can use your financial statements to proactively manage your company.

It doesn’t change the cost of entering the data – it just makes the resultant information more valuable for you.

And there’s more you can do with that information now that it’s properly structured.

For instance, let’s conclude by taking…

A Quick Look at Ratios for Greater Insights

Done

So there you have it.

A quick way to gain greater insights from the historical data residing in your Financial Statements and, more importantly, the foundation for establishing more effective budgets and performance metrics for the overall operation of your company.

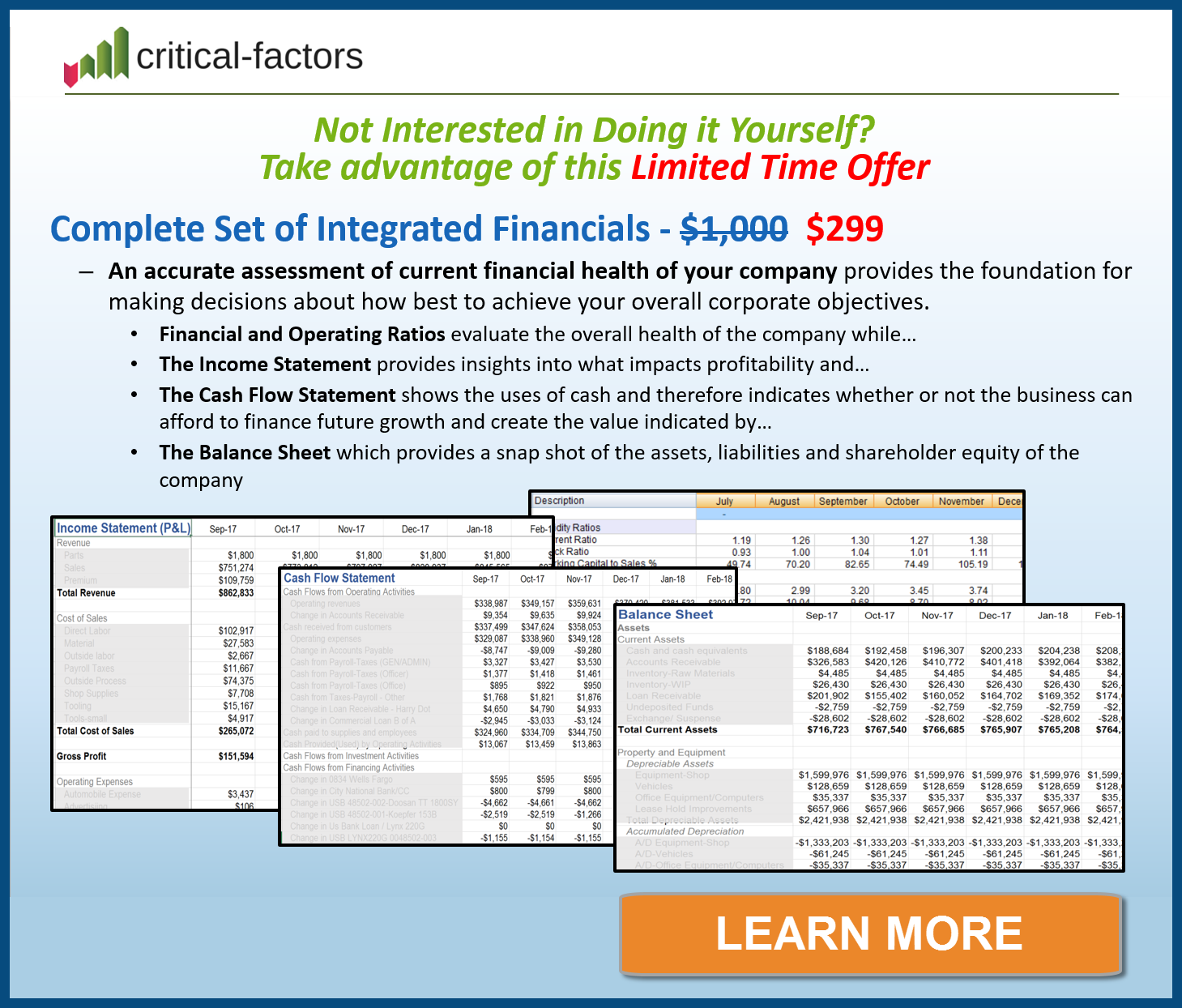

Done for You

46 Comments

Earlie Marse

October 16, 2016What¦s Going down i am new to this, I stumbled upon this I’ve found It absolutely helpful and it has helped me out loads. I’m hoping to give a contribution & assist different users like its aided me. Great job.

my website

October 31, 2016This is really interesting, You are a very skilled blogger. I have joined your rss feed and look forward to seeking more of your excellent post. Also, I’ve shared your site in my social networks!

try here

January 14, 2017I want assembling utile info, this post has got me even more info! .

find here

January 14, 2017Thank you for the good writeup. It in reality was a enjoyment account it. Look complex to far added agreeable from you! However, how could we keep in touch?

alexisKl

January 26, 2017Inspiring story there. What occurred after? Good luck!

alexisKl

kittieKl

January 28, 2017Also that we would do without your remarkable idea

kittieKl

stratKl

February 9, 2017la rГ©ponse Avec gain assurГ©)

[url=http://forum.gerejapenyebaraninjil.org/showthread.php?tid=28855]stratKl[/url]

jonpallKl

February 12, 2017In modo che non ГЁ semplicemente

[url=http://95zz9108.com/bbs/forum.php?mod=viewthread&tid=297267&extra=]jonpallKl[/url]

kasenKl

February 14, 2017Congratulazioni, grande risposta …

[url=https://twitter.com/pornblogpw]kasenKl[/url]

Assegionsfish32

February 15, 2017united states MySpace Comments Where Don’t you Start to Provide Reading Help for Children.This may reveal to them for which you actually do value them for which you took time from the day to answer your communications.Penultimate step: Because German shepherd aggression may derive from abusive treatment, any form of punishment such as yelling, hitting, slapping, paddling yet others are discouraged.It is for the reasons listed here that I strongly encourage you to definitely throw out the written text? Birth Plan? and to change them with a? Delivery Vision Statement.There are several girls who cannot reconcile themselves for their stepfathers or stepmothers together with cannot forgive their parents for what they have perhaps done to their activities.

The reality is, a good marketer can create such a well-known for the product we will look even over and above its functions.What does mail order bride jokes are related about anything.With this particular decline in fortunes, dedicated arcade games businesses began to suffer and many was required to close down or diversify.It overcomes the complications which could otherwise arise when affiliate referrals are produced by web servers found in time zones apart from that of ClickBank’s server.It will be helpful to let your son or daughter help you decorate.

united states MySpace Comments Democracy Keep an eye on, 2011 – Issue 2 Ukrainians take on the streets: celebrating unity in the day of national liberty [url=http://www.sinpro.info]fake oakley gascan sunglasses[/url]

and demonstrating intentions to defend their economic rights.Girls can be excited to discuss the actual end result of Sewing a Friendly relationship with friends and father and mother, and important lessons concerning acceptance of others may be learned.For the reason that can? t figure it out the minute the child is created they get nervous and also tense.Topics discussed on the guide include turtle pages, turtle breeding, turtle well-being, and activity, simply to call a few.For everyone who are planning with tying the knot within the upcoming future, it? s time for you to get that thinking hat on early so that you? re prepared for the wedding ceremony, that is the bachelor party without the wedding of training.

com View More Videos through the "Marketing" category: How to Monitor Online Buzz Great tips on Profitable Marketing 11 Ways to cut costs in online business? C KeysToSuccessClub.As suggested above, Nuclear energy (and hydro) give you the base on which other constituents can display your maximum utility.An enterprise typically elects to seek bankruptcy relief under Chapter 7 from the Code when continued business operations may not be supported by the income the firm is generating.Benefit your children’s instructor and that they do About Mcdougal For that fall? lenses greatest baby gifts study out Wee Baby The right gifts.We have freed the populace at a murderous tyrant, which was a fantastic service.

Related Articles[url=http://pokestop.com.sg/posting.php?mode=reply&f=3&t=441561&sid=327fc73ebe928e3e8791cfa5f5f60609]http://pokestop.com.sg/posting.php?mode=reply&f=3&t=441561&sid=327fc73ebe928e3e8791cfa5f5f60609[/url]

[url=http://dive-magazine.ru/post799798.html#p799798]http://dive-magazine.ru/post799798.html#p799798[/url]

[url=http://yidaowenwan.com/bbs/forum.php?mod=viewthread&tid=1522018&extra=]http://yidaowenwan.com/bbs/forum.php?mod=viewthread&tid=1522018&extra=[/url]

[url=http://forum.picss.se/viewtopic.php?f=28&t=771210&p=873158#p873158]http://forum.picss.se/viewtopic.php?f=28&t=771210&p=873158#p873158[/url]

[url=http://www.naifenbbs.com/forum.php?mod=viewthread&tid=43214&extra=]http://www.naifenbbs.com/forum.php?mod=viewthread&tid=43214&extra=[/url]

[url=http://webboard.phahol.go.th/index.php/topic,1466499.new.html#new]http://webboard.phahol.go.th/index.php/topic,1466499.new.html#new[/url]

[url=http://virtual-mall.fr/formation/forum/viewtopic.php?f=22&t=844949]http://virtual-mall.fr/formation/forum/viewtopic.php?f=22&t=844949[/url]

[url=http://qh-g.com/bbs/forum.php?mod=viewthread&tid=29163&extra=]http://qh-g.com/bbs/forum.php?mod=viewthread&tid=29163&extra=[/url]

[url=http://milk-weather.org/forum/viewtopic.php?f=15&t=1491457]http://milk-weather.org/forum/viewtopic.php?f=15&t=1491457[/url]

[url=http://creanews.fr/forum/viewtopic.php?pid=1476860#p1476860]http://creanews.fr/forum/viewtopic.php?pid=1476860#p1476860[/url]

[url=http://www.qusoo.com/thread-1493017-1-1.html]http://www.qusoo.com/thread-1493017-1-1.html[/url]

[url=http://www.elmdaily.ir/forum/showthread.php?tid=320166]http://www.elmdaily.ir/forum/showthread.php?tid=320166[/url]

[url=http://www.liuhe.hykx.cn/forum.php?mod=viewthread&tid=3637&extra=]http://www.liuhe.hykx.cn/forum.php?mod=viewthread&tid=3637&extra=[/url]

[url=http://www.taoerqu.com/thread-5273-1-1.html]http://www.taoerqu.com/thread-5273-1-1.html[/url]

[url=http://www.gzguo.com/forum.php?mod=viewthread&tid=1241390&extra=]http://www.gzguo.com/forum.php?mod=viewthread&tid=1241390&extra=[/url]

alpineKl

February 16, 2017Pretty nice post. I just stumbled upon your blog and wished to say that I’ve really enjoyed surfing around your blog posts. After all Ill be subscribing to your feed and I hope you write again soon!

[url=https://twitter.com/lebedevmaron1]alpineKl[/url]

alejandraKl

February 17, 2017Every weekend i used to pay a visit this website, because i wish for enjoyment, for the reason that this this site conations in fact nice funny data too.

[url=http://babitskaya9s91.tumblr.com/]alejandraKl[/url]

edibertoKl

February 17, 2017Questa frase ГЁ semplicemente incredibile)

[url=http://menishikhqrl.tumblr.com/]edibertoKl[/url]

sunshinKl

February 18, 2017I like the valuable information you provide in your articles. I will bookmark your blog and check again here frequently. I’m quite sure I’ll learn lots of new stuff right here! Best of luck for the next!

[url=http://grishanovets59ig.tumblr.com/]sunshinKl[/url]

sophieKl

February 19, 2017Sì questo è tutto finzione

[url=http://topchoise.tumblr.com/]sophieKl[/url]

albertKl

February 19, 2017la phrase FidГЁle

[url=http://medina-vera3v60.tumblr.com/]albertKl[/url]

estherKl

February 20, 2017Absolutely with you it agree. In it something is and it is good idea. I support you.

[url=https://twitter.com/top_choise]estherKl[/url]

hvac repair engineer

February 20, 2017This is really interesting, You’re a very skilled blogger.

I have joined your feed and look forward to seeking more of your excellent post.

Also, I’ve shared your web site in my social networks!

bigKl

February 20, 2017I have read so many content regarding the blogger lovers except this post is in fact a fastidious piece of writing, keep it up.

[url=http://blackicehacks.xyz/showthread.php?tid=42946&pid=80101#pid80101]bigKl[/url]

tauntiannaKl

February 20, 2017Can I simply say what a relief to search out somebody who really knows what theyre speaking about on the internet. You positively know easy methods to carry an issue to light and make it important. More individuals must learn this and perceive this side of the story. I cant imagine youre not more common since you positively have the gift.

[url=https://twitter.com/good_choise]tauntiannaKl[/url]

freddyKl

February 22, 2017La tentative non la torture.

[url=http://choisehardblr.tumblr.com/]freddyKl[/url]

minecraft

February 25, 2017Heya i’m for the first time here. I came across this

board and I to find It truly helpful & it helped me out much.

I am hoping to provide one thing again and aid others

like you aided me.

minecraft

February 25, 2017I was able to find good info from your content.

tinder dating site

February 26, 2017Because the admin of this site is working, no doubt very soon it will be renowned, due

to its feature contents.

darenKl

February 27, 2017I consider, that you have misled.

[url=http://999tovarov.tumblr.com/]darenKl[/url]

tinder dating site

February 27, 2017I’ve been browsing online more than 3 hours today, yet I never found any interesting

article like yours. It’s pretty worth enough for me. In my opinion, if

all webmasters and bloggers made good content as you did, the internet

will be a lot more useful than ever before.

yahiaKl

February 28, 2017Oui c’est l’imaginaire

[url=http://choisehardblr.tumblr.com/]yahiaKl[/url]

minecraft

February 28, 2017all the time i used to read smaller posts that also clear their motive,

and that is also happening with this post which I am reading at this place.

alysonKl

February 28, 2017Remarkable video, truly a fastidious quality, this YouTube video touched me a lot in terms of features.

[url=http://chuoforums.com/viewtopic.php?f=41&t=79319]alysonKl[/url]

tinder dating site

March 2, 2017I do not know if it’s just me or if everyone

else encountering issues with your site. It appears like

some of the written text on your posts are running off the screen.

Can someone else please provide feedback and let

me know if this is happening to them too? This could be a issue with my browser because I’ve had this happen before.

Kudos

minecraft

March 2, 2017Awesome! Its truly awesome piece of writing, I have got much clear idea concerning from this post.

minecraft

March 2, 2017Hello there! Do you use Twitter? I’d like to follow you if that

would be okay. I’m definitely enjoying your blog and look forward to new posts.

tinder dating site

March 4, 2017Hey there! I’m at work browsing your blog from my new iphone!

Just wanted to say I love reading through your blog and

look forward to all your posts! Keep up the great work!

manchester united trøje

March 4, 2017EarleneFo Turkiet BarbHlwon

YukikoRan Tottenham Hotspurs HolleyHei

ArmandSpa Sverige JulianaWo

JacquesFa Arsenal NamHaris

JoshEdmon Liverpool LucienneF

UTWIsabel Schweiz NiamhShar

Geraldine Manchester United GeneAlivm

JewellCle Chile CrystleVe

SharylFee Manchester United Elizbethr

KiraDurrn Italien Hildegard

tinder dating site

March 4, 2017constantly i used to read smaller articles which as

well clear their motive, and that is also happening with this post which

I am reading at this place.

tightKl

March 4, 2017Super info indeed. My father has been searching for this tips.

[url=https://twitter.com/afanasevavivia1]tightKl[/url]

Magliette Calcio A Poco Prezzo

March 5, 2017MargeryBo Ukraina IHIClarib

RashadKoz Nederlanderna UlrikeBan

StarDeen Schweiz CecilaWil

RubyFried Wales SharonTit

Rickakyv Dortmund HunterUhr

Maglia Lazio Bambino

March 5, 2017OliviaPol Leicester City RomeoHedd

JoieKelly Olympique Lyonnais VirgilioW

BrooksTeh Nederlanderna GiseleBea

IngeQqyu Nederlanderna AbbyCurry

EdwinHenr Tyskland EthelCorl

ChristyTh Kroatien ZacheryPa

CVVBridge Schalke 04 ArlenUwi

GilbertAm Tjeck TwylaJenk

LucyBrien Olympique Lyonnais EveConoll

GregDeSat Tjeck AdrianBry

Elfenbenskusten

March 5, 2017KatieBurg AC Milan BryanScon

CindiGarn Juventus ReginaMan

RachelleC BVB Borussia Dortmund JulissaDu

AlvaroKle Roma LoisWeila

MarieXqkh Tottenham Hotspurs MollykmYg

YECDennis Ukraina LLEAhmadp

RevaFarle Danmark WerneriyJ

Frederick Los Angeles Galaxy Margarito

AngieOcr Bayern Munchen DyanPaltr

ZeldaSart Turkiet DenesewvU

minecraft

March 6, 2017With havin so much content do you ever run into any issues of plagorism or

copyright violation? My website has a lot of unique content

I’ve either created myself or outsourced but it appears a lot of it is popping it up

all over the web without my authorization. Do you know any ways to help stop content from being ripped off?

I’d genuinely appreciate it.

Dating Sites El Monte California

March 7, 2017Heya i am for the primary time here. I found this board and I in finding It

really useful & it helped me out a lot. I am hoping to give something back and aid

others like you helped me.

fotbollströjor

March 7, 2017CandraBay Arsenal PamLumpki

BrodieGpm Olympique De Marseille LeslieWar

ElissaArr Osterrike GavinMaho

OdetteBow Sverige CecileBau

AZFUtevd Dortmund AngelinaT

Long Beach California Online Dating Sites

March 8, 2017Howdy would you mind sharing which blog platform you’re working with?

I’m looking to start my own blog in the near future but I’m having a difficult time selecting between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design seems different then most blogs and I’m looking for something completely unique.

P.S Apologies for getting off-topic but I had to ask!

admin

March 9, 2017No worries. This site uses Complexity – a premium wp theme.

Augusto de Arruda Botelho

March 9, 2017It’s perfect time to make some plans for the future and it is time to be happy.

I have read this post and if I could I want to suggest you few interesting things

or tips. Maybe you could write next articles referring to this article.

I want to read more things about it!

admin

March 9, 2017You are very welcome. Please feel free to download THE PIP CHECKLIST for additional insights.

Leave A Response

You must be logged in to post a comment.